I now do not know what to do. You set up a sell order for a specific value and when someone comes along looking to buy at the agreed upon price, the site will alert you that you can move ahead with the transaction. Buy Bitcoin Worldwide, nor any of its owners, employees or agents, are licensed broker-dealers, investment advisors, or hold any relevant distinction or title with respect to investing. Does one need a bitcoin atm card to withdraw bitcoin from his wallet? Please visit Coinbase Pro for its exact pricing terms. The best wireless routers for 4 days ago. Update: LocalBitcoins no longer does cash trades.

By using our site, you acknowledge that you have read and understand our Cookie PolicyPrivacy Policyand our Terms of Service. I’m using the Cryptsy API with a bot. So far, my bot’s problem is that tfansfer it decides it needs to buy or sell a coin not just bitcoinI always seem to compute a price that is way too low or high. The data I have access to is:. From all of this data, is there an existing algorithm to compute a price that x almost always buy or sell? My bot’s priority is to have fast trades like, less than a minute for executioneven if the price is not the best.

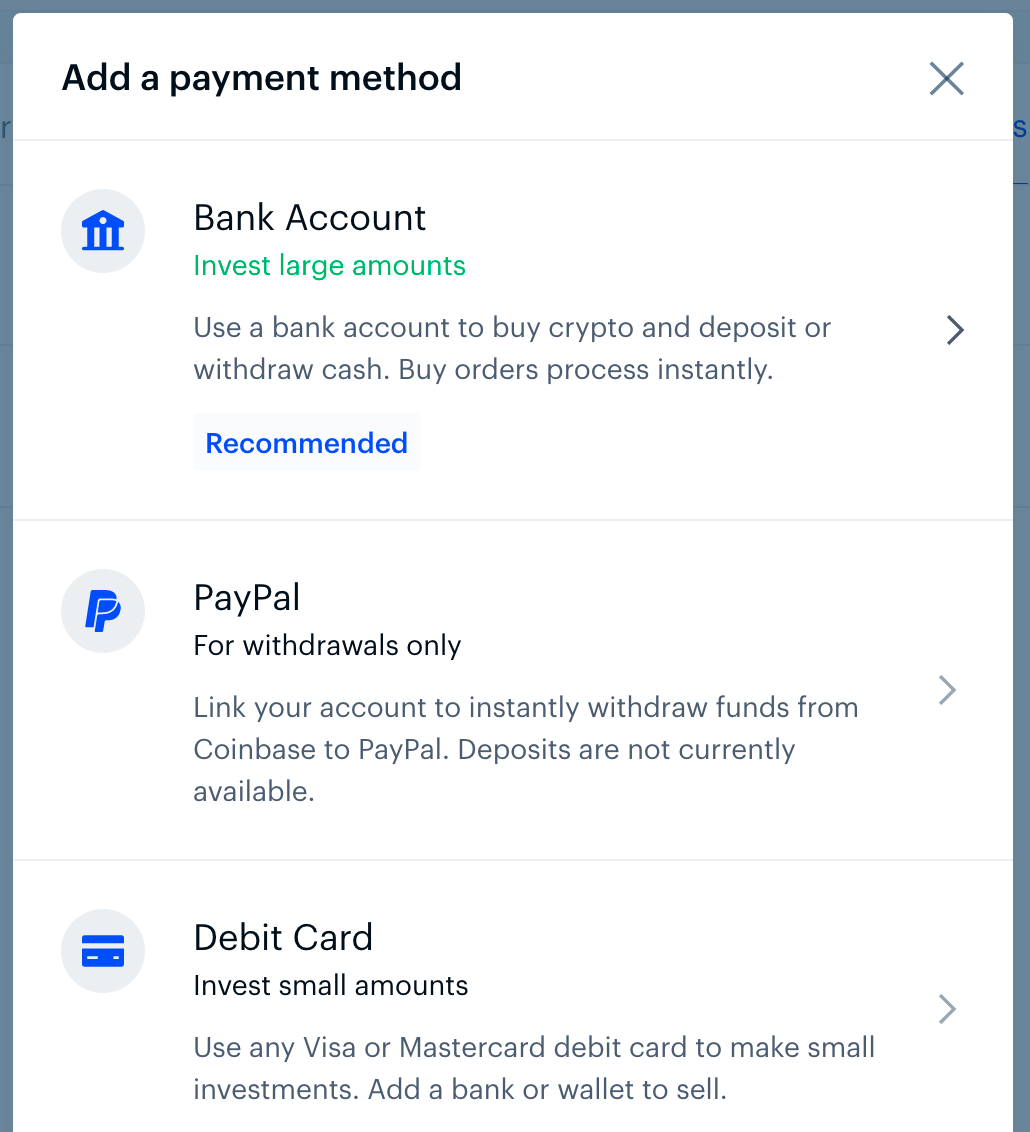

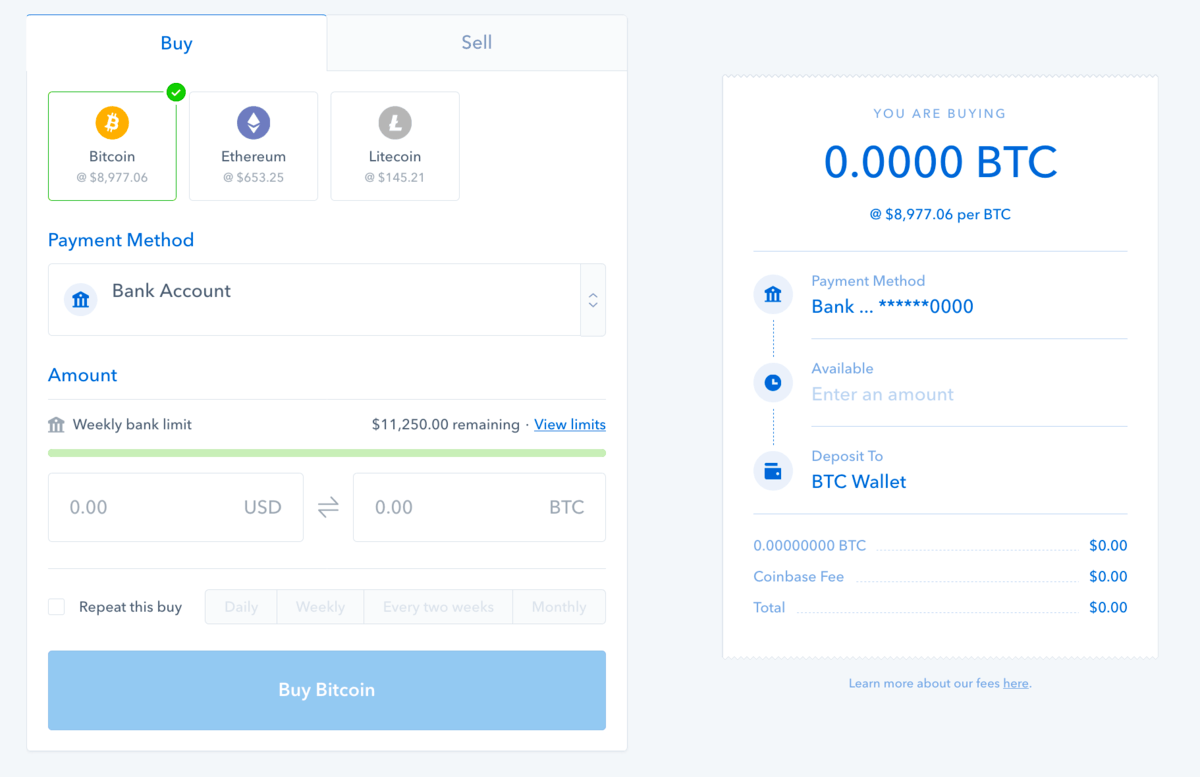

What are the pros of buying with a bank account?

However, if you are looking to cash out your digital currency to physical money or goods, you should consider selling your coins directly to a person, who wants to exchange his or her money or goods for cryptocurrency P2P. Our choice here is LocalCoinSwap. As Bitcoin and cryptocurrency continue to explode in popularity, more and more services are coming online to help users get their hands on bitcoin or turn their BTC into USD or other fiat currency in a quick and effective way. There are several methods for selling BTC, each a little different from each other. One of the most common and simplest ways to sell bitcoin online and convert it into hard cash is through an exchange platform. Exchanges act as a middle-man by selling your BTC for you.

What are the cons of buying with a bank account?

By using our site, you acknowledge that you have read and understand our Cookie PolicyPrivacy Policyand our Terms of Service. I’m using the Cryptsy API with a bot. So far, my bot’s problem is that when it decides it needs to buy or sell a coin not just bitcoinI always seem to compute a price that is way too low or high. The data I have access to is:. From all of this data, is there an existing algorithm to compute a price that will almost always buy or sell?

My bot’s priority is to have fast trades like, less than a minute for executioneven if the price is not the best. I had been thinking about this lately and haven’t explored this option at ALL but I’m thinking out loud here because nobody has replied in 8 days.

So what if you took the average of the top orders 1 — 5, then the average of the top orders 2 — 6, the average of 3 — 7, ect. The process could be repeated as nessecary to find an average of averages that hover around the top of the buy points. It took quite a bit of thinking, but here is how you arrive at a «buy instantly» or «sell instantly» price. We can gain a lot from this simple set of orders.

For one, the market depth chart becomes very useful when looking at this data. Now, lets say we have LTC we want to sell. The way you would pick the best sell instant price is to look at the buy orders. So, 5BTC should be your max rate. Depending on the API you are using, you might want to place two separate orders at different prices or place one with the max price assumed. It works the same way with buying. So, your max price would be 8BTC.

Although your actual price would vary quite a lot. It depends on what service and API you’re using as to how to best place such an order spanning prices. Crypsty automatically chooses the best price for you, so you would have this effect. However, it’s not guaranteed to work this way. If you got the order list, and someone was to buy up 50BTC at 6BTC, then your expected price would end up being wrong.

If you want a price guarantee, you should place exact matching orders to the order book. Following this method though, you have a high likelyhood of an order not completing as well, or taking longer than expected, such as if you buy LTC at 6BTC, but someone bought 50LTC. Crypsty by default would wait a while before completing the partial order. It’s actually a really simple concept, but it took me a few days to actually wrap my head around it for some reason.

Hopefully if other people have the same problem, maybe this post will clear things up for. A market maker will always match orders. You must have someone who wants to buy at the price you wish to sell, and visa-versa. If you put in a low price to sell at, you aren’t guaranteed to sell at that price. Granted, the market maker may fill other buy orders that are higher than what you are asking, but, again, it’s not guaranteed.

The key to high-volume buy-sell bots is to look for volume. More volume means a bigger market and more opportunities to buy and sell. There are a bitcoin as a transfer method high buy sell proice of websites, like Cluedex.

Using this data, you can determine which markets you are more likely to trade more quickly. Home Questions Tags Users Unanswered. Asked 5 years, 11 months ago.

Active 10 days ago. Viewed 1k times. The data I have access to is: The currently outstanding buy orders though a few seconds old and without timestamps The currently outstanding sell orders The previous 20 trades that were executed on the market From all of this data, is there an existing algorithm to compute a price that will almost always buy or sell?

Earlz Earlz 2 2 gold badges 9 9 silver badges 26 26 bronze badges. ChrisSavoie ChrisSavoie 1. Look at my answer. Laser-Lance Laser-Lance 56 5 5 bronze badges.

Sign bitcoin as a transfer method high buy sell proice or log in Sign up using Google. Sign up using Facebook. Sign up using Email and Password. Post as a guest Name. Email Required, but never shown. Featured on Meta. Update: an agreement with Monica Cellio. Related 4. Hot Network Questions. Question feed. Bitcoin Stack Exchange works best with JavaScript enabled.

How to buy Bitcoin for Beginners

Bitstamp Buy Bitcoin Bitstamp is one of the world’s largest Bitcoin exchanges. You can only pay via bank wire at this time. Limits are also usually higher when using a bank account, assuming you have verified your account. So, no matter where you are from, you should be able to find buyers to sell your Bitcoin to. Has anyone transferred bitcoin balance anyway they wish into an EMPTY normal bank account and withdrawn all the balance as cash? I received an Email saying that my request was under revue and I should be informed as soon as a decision was made. Holiday Gift Guide. LocalBitcoins is just one of the P2P exchanges that allow you to cash out your Bitcoin — there are many. The best wireless routers for 4 days ago.

Comments

Post a Comment