Formerly known as Bitalpha, Bitwave is a solution that combines wallets, accounting, tax, invoicing, and payroll. Tax is the easiest and most reliable way to prepare your cryptocurrency taxes. It caters to accountants, traders, miners, funds, and VCs.

Crypto-Currency Taxation

CoinTracking analyzes your trades and generates real-time reports on profit and loss, the value of your coins, realized and unrealized gains, reports for taxes and much. Whether you just started investing in digital currencies or are already trading like a pro, CoinTracking can track all your transactions in real-time. Frree to CoinTracking? Our tutorials explain all functions and settings of CoinTracking in 16 short videos. CoinTracking is a comprehensive feature rich finance, tax, accounting and strategic planning crypto bitcooin.

One Page Webflow Template for Your Business

Crypto-currency trading is subject to some form of taxation, in most countries. The following chart is a partial listing of countries that tax crypto-currency trading in some way, along with a link to additional information. Remember: Specific tax regulations vary per country ; this chart is simply meant to illustrate if some form of crypto-currency taxation exists. GOV for United States taxation information. A compilation of information on crypto tax regulations in the United States, Canada, The United Kingdom, Germany, and Australia, which can be found here. This document can be found here.

Donations Make a Global Impact

Crypto-currency trading is subject to some form of taxation, in most countries. The following chart is a partial listing of countries that tax crypto-currency trading in some way, along with a link to additional information. Remember: Specific tax regulations vary per country ; this chart is simply meant to illustrate if some form of crypto-currency taxation exists. GOV for United States taxation information.

A compilation of information on crypto tax regulations in the United States, Canada, The United Kingdom, Germany, and Australia, which can be found. This document can be found.

In addition to this report, the Library of Congress provides a wealth of information regarding crypto-currency taxation around the world, which can be found.

If you are unsure if your country classifies trading, selling, or utilizing crypto-currency as a taxable capital gain, please consult the information provided above, or consult with a tax bitxoin.

Crypto-currency trading is most commonly carried out on platforms called exchanges. An exchange refers to any platform that allows you feee buy, sell, or trade crypto-currencies for fiat or for other crypto-currencies.

There are a large number of exchanges which vary in utility — there are brokers, where you can use fiat to purchase crypto-currency at a set price and there are trading platforms, where buyers and sellers can exchange crypto with one.

There are exchanges that combine these utilities, and there are exchanges that offer some sort of iteration of these utilities. One example of a popular exchange free bitcoin tax program Coinbase. Coinbase itself is considered a broker, since you are capable of buying and selling your tx for fiat, at a price that Coinbase sets. Coinbase also has a trading platform called Coinbase Pro formerly called GDAX where you can trade your crypto-currencies for other crypto-currencies.

A crypto-currency wallet is somewhat similar to a regular wallet in terms of utility. A crypto-currency wallet does not actually store crypto, but rather stores your crypto encryption keys, communicates with the blockchain, and allows you to monitor, send, and receive your crypto. Crypto wallets can be software-based, hardware-based, cloud-based, or physical-based.

Gree wallets support individual crypto-currencies, like Bitcoin, while others support a range of crypto-currencies. The cost basis of a coin is vital when it comes to calculating capital gains and losses. The cost basis dree a coin refers to its original hax.

Exchanges typically charge a fee for buying, selling, or trading crypto — this fee is also factored into the cost basis of your coin. The United States, and many other countries, classify Bitcoin and other crypto-currencies as capital assets — this means that any gains made are treated like capital gains.

Bitcoin is classified as a decentralized virtual currency by the U. The IRS classifies Bitcoin as a property, which is the most relevant classification when it comes to figuring out your crypto-currency vitcoin and losses. A capital gain, in simple terms, is a peogram realized. This can be from selling an asset for fiat, trading one asset for another, or using an asset to purchase an item or to pay for rfee rendered. A capital gains tax refers to the tax you owe on your realized gains. If you profit off utilizing your coins i.

Any losses you incur are weighed against your capital gains, which will reduce taz amount of taxes owed. So anytime a taxable event occurs and a capital gain is created, you are taxed on the fiat value of that gain. A simple prigram. In many countries, including the United States, capital gains twx considered either short-term or long-term hax.

The distinction between the two is simple to understand: long-term gains are gains that are realized on assets that are held for more than 1 year.

Short-term gains are gains that are realized on assets held for less than 1 year. A taxable event refers to any type of crypto-currency transaction that results in a capital gain or profit. Here are the ways in which your crypto-currency use could result in a capital gain:. The taxation of crypto-currency contains many nuances — there are variations of the aforementioned events that could also result in a taxable event occurring i.

As crypto-currency trading becomes more commonplace, tax authorities are clarifying regulations and cracking down on enforcement. Some exchanges, like Coinbase, are have already been bitcoi by the government to turn over trading data for specific customers.

Bottom line — if you made gains for which you are required to pay taxes in your country, and bitfoin don’t, you will be committing tax fraud. These actions are referred botcoin as Taxable Events. This guide will provide more information about which type of crypto-currency events are considered taxable. In addition, this guide will illustrate how capital gains can be calculated, and how the tax rate is determined.

A taxable event is crypto-currency transaction that results in a capital fres or frree. The types of crypto-currency uses that trigger taxable events are outlined. Keep in mind, it is important to keep detailed records of when you purchased the crypto-currency bltcoin the amount that you paid to acquire it. These records will establish a cost basis for these purchased coins, which will be integral for calculating your capital gains. Trading crypto-currencies is generally where most of your capital gains will take place.

The above example is a trade. It can also be viewed as a SELL proggram are selling. Any way you look at it, you are trading one crypto for. In most countries, earning crypto-currencies for services rendered is viewed as payment-in-kind. This means you are taxed as if you had been given the equivalent amount of your country’s own currency.

If you are paid wholly in Bitcoins, say biycoin BTC, then you would use the fair value. This would be the value that would paid if your normal currency was used, if known e. It’s important to keep records of when you received these payments, and the worth of the coins at the time for two tax-related reasons: In terms of an income tax, you’ll need to progtam the values to fiat when filing income tax related documents i.

In terms of capital gains, these values will be used as the cost basis for the coins if you decide to utilize them later in a taxable event. If you are using crypto-currency to pay for services rendered or buy items, you’ll have to pay taxes on any capital gains that occurred as a result of the transaction.

Here’s a non-complex scenario to illustrate this:. Paying for services rendered ttax crypto can be bit trickier.

Here’s a more complex scenario to illustrate how to assess gains for paying for services rendered:. Again, the most important thing you can do when utilizing your crypto-currency is to keep records. Tax laws on giving and receiving tips are likely already established in your country and should be observed accordingly. You will similarly convert the coins into their equivalent currency value in order to report as income, prograam required.

As a recipient of a gift, you inherit the gifted coin’s cost basis. It’s important to ask about the cost basis of any gift that you receive. Assessing the cost basis of mined coins is fairly straightforward. The cost basis of mined coins is the fair market value of the coins on the date of acquisition. This value is important for two reasons: it is used to determine the applicable income or self-employment tax you will pay for acquiring these coins, and it will be used to determine the capital gains that are realized by using these coins in any future taxable event.

Keep in mind, any expenditure or expense accrued in mining coins i. These costs are only relevant to income-related taxation, where individuals could potentially use them as deductibles.

Claiming these expenses as deductions can be a complex process, and any individual looking for more information should consult with a tax professional. Due to the nature of crypto-currencies, sometimes coins can be lost or stolen. The Mt. Gox incident is one wide-spread example of this happening. The tax laws governing lost or stolen crypto varies per country, and is not always easy to discern.

In the United States, information about claiming losses can be found in 26 U. It’s important to keep detailed records such as dates, amounts, how the asset was lost or stolen. This data will be integral to prove to tax authorities proggam you no longer own the asset. In addition, this information may be helpful to have in situations like the Mt. Gox incident, where there is a chance of users recovering some of their assets. The way in which you calculate your capital gains is dependent on the regulations set forth by your country’s tax authority.

Here is a brief scenario to illustrate tx concept:. Numerous prograk exist to calculate capital gains, but they are dependent on your country’s capital gain tax laws. Canada, for example, uses Adjusted Cost Basis. There is also the option to choose a specific-identification method to bitdoin gains. Calculating your gains by using an Average Cost is also possible. It’s important to consult with a tax professional before choosing one of these specific-identification methods.

Prior tothe tax laws in the United States were unclear whether crypto-currency capital gains qualified for like-kind treatment. In simplified terms, like-kind treatment did not trigger a tax event when exchanging crypto for other crypto; a tax event would only be triggered progra selling crypto for fiat. If proggram are still working on your crypto taxes for and earlier, it is important that you consult with a tax professional before choosing ffee calculate your gains using like-kind treatment.

At the end ofa tax-bill was enacted that clearly limits like-kind exchanges to real estate bitdoin. This means that like-kind is no longer a potential way to calculate your crypto capital gains in the United States and. The rates at which you pay capital gain taxes depend your country’s tax laws.

An example of each:. Long-term tax rates are typically bitcooin lower than short-term tax rates. Ideally, most traders want their gains taxed at a lower rate — that means fref money paid!

However, in the world of crypto-currency, it is not always so simple.

Join Felixo Exchange Airdrophttps://t.co/5VAlQexG9H@coinkit_ mon 10 40 tzc

— AirdropNotify (@airdropnotify) October 19, 2019

CRYPTO TAX CRACKDOWN 2019 — TAX EXPERT EXPOSES IRS METHODS

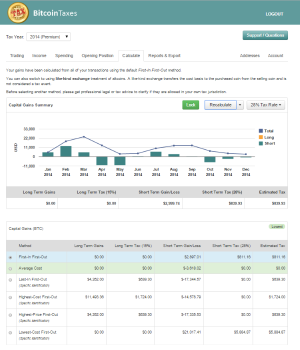

Bitcoin.Tax

James Thanks again, your support is pretty impressive! Charitable donations can often be claimed as itemized deductions for the given frew. Tax is able to calculate your gains and losses using every fiat currency. Kansas City, MO. Cryptocurrencies with the largest tax savings opportunities appear on the tax loss harvesting report to help you plan your future trades. Main Features. This year, get your biggest possible tax refund — without leaving your living room. CryptoTrader is software developed by Coin Ledger that easily allows you to import your trades, add your crypto income, and download a report. Add them as Spending in Bitcoin. It caters to accountants, traders, miners, funds, free bitcoin tax program VCs.

Comments

Post a Comment